Why Organizations Should Focus on the Importance of Risk Management Now More Than Ever

Why the Relevance of Risk Management Can not Be Neglected in Today's Economy

In today's rapidly developing financial landscape, the role of Risk Management has come to be critical. This increases a crucial concern: can the value of Risk Management in making sure stability and sustainability be forgotten?

Comprehending the Idea of Risk Management

The Function of Risk Management in Today's Economy

Having understood the principle of Risk Management, we can currently explore its duty in today's economic situation. In the context of an uncertain economic landscape noted by quick global events and technological modifications, Risk Management becomes a crucial critical part, contributing to the stability, sustainability, and total strength of economic climates on both a macro and micro range.

The Impact of Disregarding Risk Management

Ignoring Risk Management can result in dire consequences for any type of company or economic climate. When prospective dangers are not recognized, analyzed, and alleviated, companies subject themselves to usually significant and unanticipated damages. These can materialize as economic losses, reputational damage, operational interruptions, or even lawful problems. In today's unsteady financial climate, an unanticipated dilemma can swiftly intensify, leaving an ill-prepared organization rushing for survival. The global monetary crisis of 2008 acts as a raw suggestion of the devastating influence that forgeting Risk Management can have on the economy at big. Thus, overlooking Risk Management not only threatens specific businesses yet can destabilize the entire economic situation, highlighting the pivotal duty played by efficient Risk Management in today's financial landscape - importance of risk management.

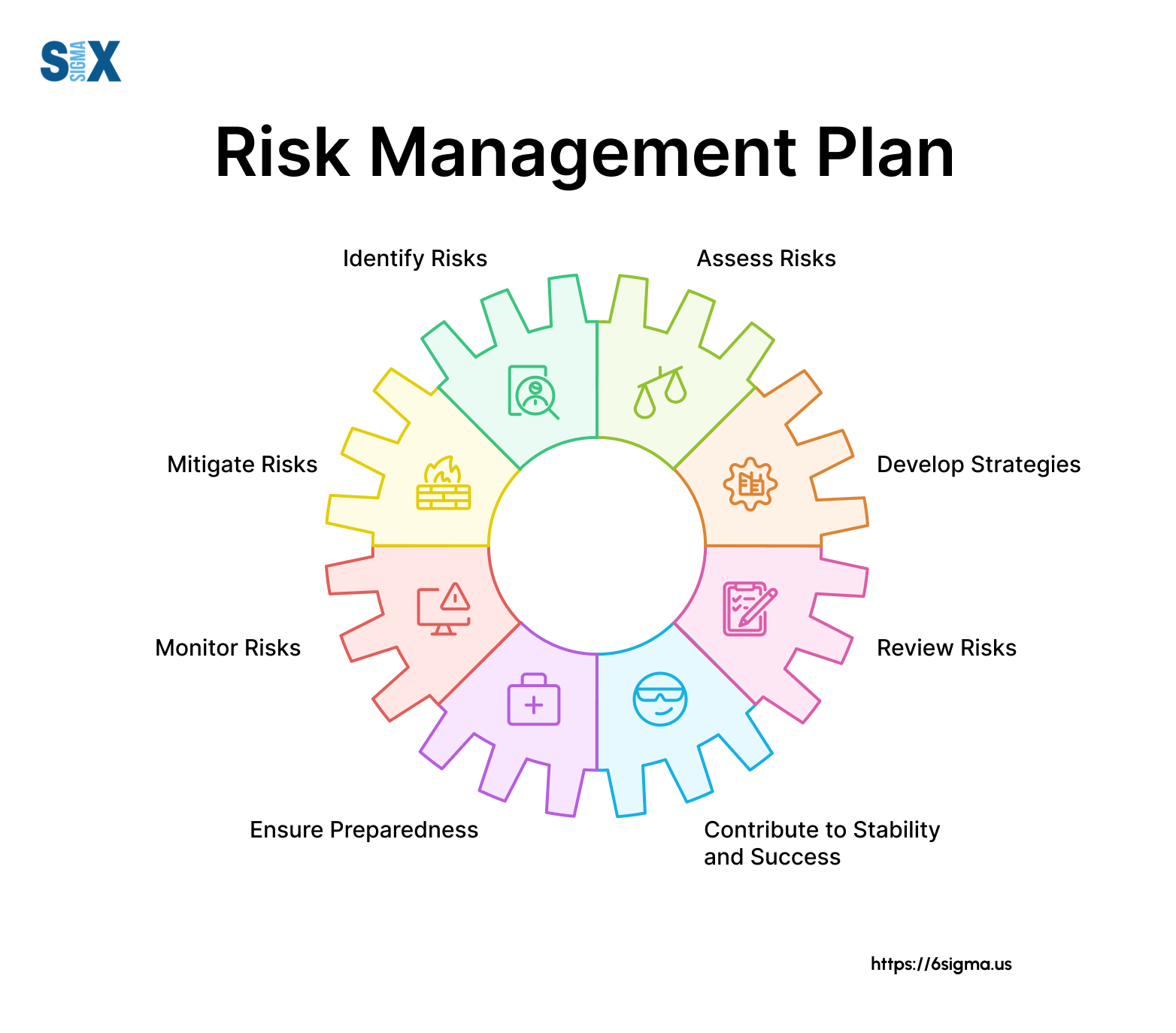

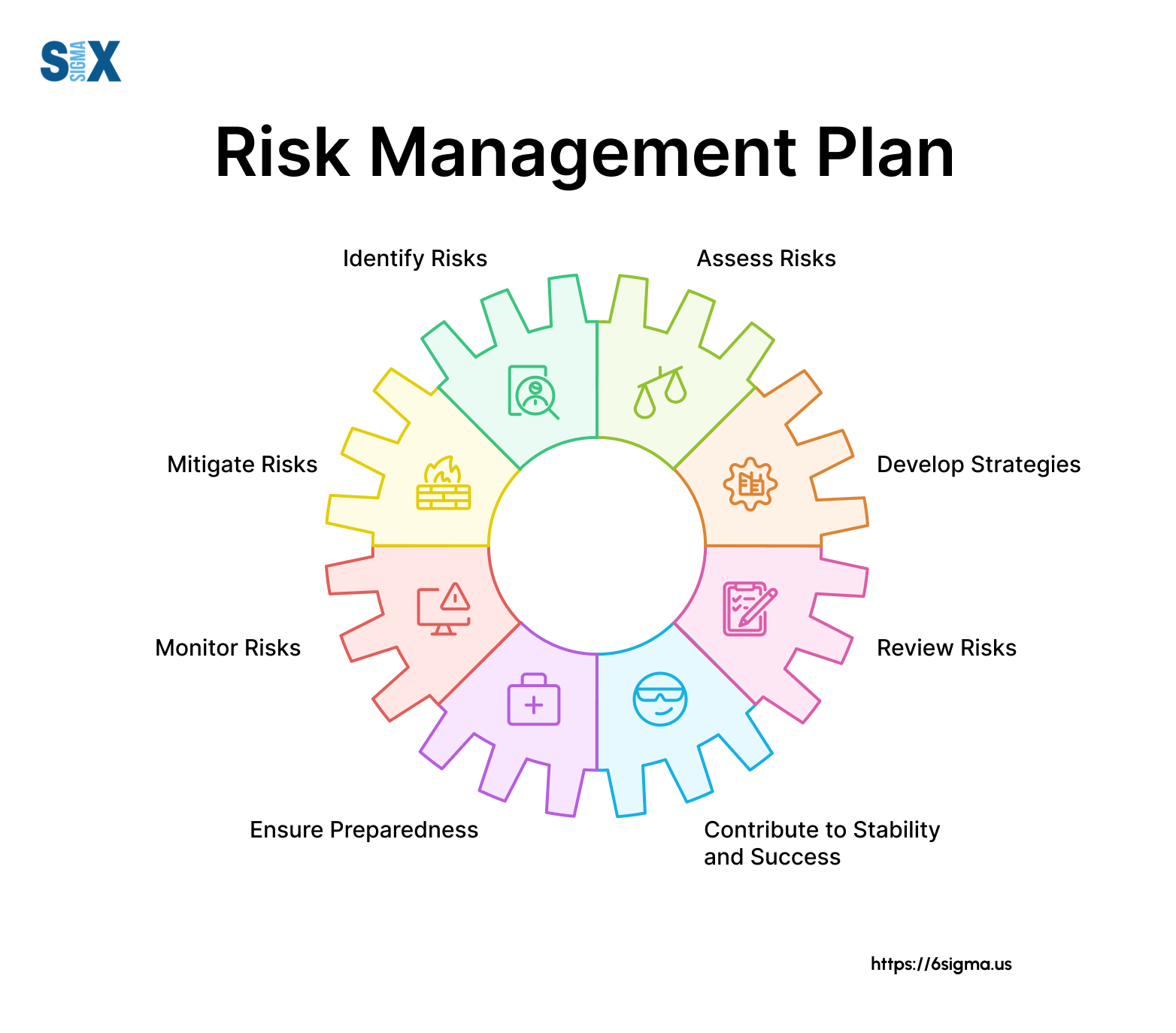

Secret Components of Reliable Risk Management Techniques

Effective Risk Management techniques revolve around two key elements: applying and recognizing possible threats reduction measures. To guarantee the security and sustainability of a service, these aspects need to not be overlooked. In the following discussion, these important elements will be checked out carefully.

Determining Prospective Dangers

Why is recognizing possible dangers critical in any kind of Risk Management approach? Identification of potential threats is the keystone of any kind of efficient Risk Management approach. It involves the systematic examination of business landscape, both exterior and internal, to uncover risks that can hinder an organization's strategic purposes. Determining possible dangers allows companies to anticipate troubles, instead of simply react to them. This positive technique encourages companies to take care of uncertainty with confidence, by highlighting areas that call for additional attention and planning. It also allows them to prioritize resources successfully, concentrating on dangers that might have the most significant influence on their operations. Generally, the process of identifying prospective dangers is an essential action in fostering click this organization resilience and promoting sustainable development.

Carrying Out Reduction Measures

Browsing via the volatile company waters, companies embark on the essential journey of carrying out mitigation steps as component of their Risk Management techniques. These measures, created to decrease the effect of potential threats, form the foundation of a durable Risk Management plan. They include different methods, consisting of transferring the Risk to another celebration, avoiding the Risk, reducing the adverse effect or likelihood of the Risk, or even approving some or all the consequences of a particular Risk. The option of approach relies on the company's details context, Risk resistance, and ability to birth losses. Effective mitigation needs cautious planning, routine revision, and consistent vigilance. In a turbulent economic situation, these procedures raise strength, making certain long-lasting survival and development.

Instance Researches: Successful Risk Management in Method

Regardless of the complexities included, there are a number of circumstances of effective Risk Management in technique that demonstrate its critical duty in company success. The car manufacturer quickly established a danger Management team that lessened manufacturing downtime by determining alternate suppliers. These instances highlight that effective Risk Management can not only safeguard organizations from potential risks but also allow them to take chances.

Future Fads in Risk Management: Adapting to a Dynamic Economic Situation

Looking ahead, the landscape of Risk Management is poised for considerable changes as it adapts to a dynamic economic climate. Technological improvements are expected to change the field, with More Info automation and expert system playing an essential role in Risk recognition and mitigation. This shift will certainly require a new ability established for Risk supervisors, who will need to be skilled at making use of these technologies. At the exact same time, the boosting intricacy of international markets and the unpredictability of geopolitical occasions are making Risk Management more challenging. For that reason, a pattern towards even more integrated, holistic strategies to handling risks that take into consideration a variety of circumstances is expected. importance of risk management. This will be essential in browsing the intricacies of the future financial atmosphere.

Final thought

Finally, Risk Management plays an important function in today's volatile and interconnected economic climate. Its forget can lead to serious implications This Site for services and the broader economy. Successful Risk Management approaches can reduce potential threats and minimize losses, essential for the stability and sustainability of a company. As the economic climate continues to develop, so must run the risk of Management strategies, underscoring its continuous value in an ever-changing business landscape.

A proper Risk Management method is not concerning removing dangers completely - an accomplishment nearly impossible in the volatile world of business. Therefore, disregarding Risk Management not just threatens specific organizations yet can undercut the entire economic climate, emphasizing the crucial role played by efficient Risk Management in today's economic landscape.

Effective Risk Management techniques revolve around two vital parts: identifying potential risks and executing mitigation procedures.Why is determining prospective threats vital in any Risk Management method? They include different strategies, consisting of transferring the Risk to an additional party, avoiding the Risk, reducing the negative effect or possibility of the Risk, or also accepting some or all the repercussions of a specific Risk.